UGS: A PLM Powerhouse

UGS is fast growing through the following actions it took these years, which leads to its soring high.

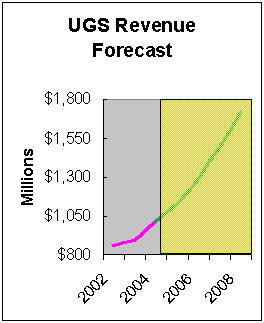

With four million users, double digit revenue growth, a three billion dollar revenue target, about a billion dollars in company revenues in 2004, and a "We never let a customer fail" mantra, UGS is rapidly establishing itself as a PLM industry powerhouse.

With strong backing from its private equity fund sponsors, Bain Capital, Silver Lake Partners, and Warburg Pincus who together have more than $37 billion of assets; a strong recurring revenue stream of about $390 million or 40% of total sales in 2004; $86 million in cash on its balance sheet; and reportedly closing twice the number of million-dollar plus orders in Q1 2005 than in Q1 2004 – suggesting that very large enterprises have confidence in UGS, its product vision and its staying power – the company is clearly positioning itself for an IPO.

PLM is as much about vision and credibility as it is about technology. Of course, the software has to work and work reliably, and users have to be able to integrate it into their existing IT environments. But in PLM, as in many other IT domains, a large and satisfied user base and a marketplace that looks to you for the keys to the future, trumps incremental technological advantage every time. The first factor – satisfied users – is a UGS strength, thanks to the company’s unrelenting efforts in this area. The second, presenting the marketplace with a credible vision of the future – is UGS’s strategic opportunity as well as its future challenge.

UGS had, in the past, been long on technology and short on vision. Today’s UGS is turning into a powerful and aggressive marketing machine, honing its vision to be as sophisticated as its technology. Its new executive team has rolled out an inspiring vision and mission and completely revised the company’s marketing and sales execution strategy. UGS is quickly repositioning itself from a product and services company to a solutions provider offering a compelling vision of the future. This vision stresses how UGS’s solutions lead to more streamlined processes that spur innovation.

As part of the repositioning, the company is doing more to highlight its past business successes and future market prospects – both key decision factors for large companies making long-term commitments to the important business technology that is PLM. The company appears to be striving for a more aggressive posture as it engages with competitors, customers and prospects.

New EVP marketing Dave Shirk has created a sales and marketing program focused on growth that promotes innovation, open systems, and integrated PLM – all key market drivers. While Shirk, an enterprise software veteran, acknowledged the challenges he faces ensuring that the UGS sales force and executive team stay on message, there is already evidence of a revitalized team speaking with one voice. Another executive joining UGS with star billing is Jim Milton, taking over as EVP of sales, who has the boardroom presence and enterprise experience to bring new levels of professionalism to UGS’s sales execution. But most important, the company continues to benefit from the stability and strong leadership provided by long-time CEO Tony Affuso and EVP Products Chuck Grindstaff who have built up an enviable, trusted reputation in the industry and have transformed UGS into a customer-friendly company.

This customer loyalty, and the very positive long-term relationships it spawns, has long been a UGS strength. In fact, the company reports that its top 100 customers have been clients for an average of 16 years – a true feat considering the evolution of technology over that period. This off-the-balance-sheet asset has served the company well and promises to translate into sales growth going forward. UGS may not have always won additional business at its existing customers, but it has rarely lost: Invariably, it stays in the game.

UGS’s sales force had been hampered by the rigid and sometimes counterproductive disciplines of its former owner, EDS. Now that UGS is on its own, it is already doing a better job of protecting its turf in core industries and expanding into verticals such as consumer packaged goods, high-tech and shipbuilding.

In the three major PLM segments – CAD, CAE and PDM – UGS owns 14% of the CAD market, 7% of the CAE market but 35% of the PDM market, almost twice the PDM share of its nearest rival. Overall, UGS owns 18% of the PLM market, capitalizing on its strength in PDM and mounting a vigorous challenge in the other two areas.

UGS’s leadership in PDM speaks to the company’s ability to deal with the technical complexities of many thousands of users accessing information in real time – but also to UGS’s ability to support the intricate business processes found at the world’s largest automotive and aerospace companies. The company reports that it has 13 customers with PDM implementations of over 10,000 seats and refers to installations as large as 50,000 seats. Building a system robust enough to handle this many concurrent users is no small feat, and something that we believe is unmatched in the industry.

Indeed, the Teamcenter brand, already well-respected, is gaining strength as some of the world’s leading automotive and aerospace manufacturers continue to invest in it and commit more of their enterprise data to its keep. It is said that UGS’s PDM products manage over 90% of installations of over 1,000 seats, including many using CAD products outside the UGS family. UGS is now well positioned to capitalize on its presence in these accounts to promote its CAD brands.

While recognizing that CAD delivers more than sixty percent of the company’s revenues, CAD dominance presents UGS with some difficult, but not insurmountable, challenges. In CAD, UGS is challenged by deeply entrenched competitors both at the high end of the market as well as in its mainstream. One competitor has a user base an order of magnitude larger. In other cases, competitors are perceived to be de facto standards in important segments of the industry.

But far from being knocked out of the CAD race, UGS is fighting back with its NX technology, seeking large vertical market openings, niche distribution channels, and whatever macro market advantage it can muster. Recent significant CAD wins include sales to Isuzu Motors Limited, Visteon, Mahindra Engineering, Rolls Royce Aero, LGE, Asus Tek Computer, Dresser Rand, and Applied Material. The company has tapped niche markets such as consumer products with a sale to Procter &Gamble; the process industry with a sale to Anheuser-Busch; and shipbuilding with a sale to HDW, a leading German shipbuilder.

Market leadership in CAD has historically been fleeting. CADAM led the field in the early 1980s, only to lose out as Computervision took the lead. Later PTC was beating all comers. These companies lost their leadership positions because they over-estimated the loyalty of their installed base or lacked the ability to keep up technologically. In 2005, market leadership in CAD can be credibly claimed by Autodesk and Dassault Systemes, with UGS not far behind. UGS’s ability to prevail in CAD will depend as much on its own efforts as on the mistakes of its rivals. To stay out front, the market leaders will have to remain adaptive and innovative in the face of UGS’s strong challenge, which is based on technology, quality, an open systems approach, and a “customer first” attitude.

UGS, like its rivals, has made important acquisitions and has a good track record of absorbing them into its business process and culture. This pace of acquisitions has accelerated since UGS gained its independence in May 2004, with 4 acquisitions in the first year alone.

Perhaps the most important acquisition UGS has made over the past few years was SDRC, which it acquired in 2001 for $950 million. In this deal, UGS obtained the Metaphase PDM system, which has become the gold standard of the industry. Metaphase has morphed into the Teamcenter product line, a testament to UGS’s good product management. On the CAD side, SDRC brought with it the I-DEAS line of products and its customers, which included some automotive industry heavyweights. Now a part of the NX line of high-end CAD products, I-DEAS NX offers its users a continuing and steady stream of new functionality as well as a migration path to the next generation NX product line.

Although criticized at the time by some analysts, the acquisition of SDRC has proven to be a key element of UGS’s value and success. Indeed, the products and technologies acquired in the deal have become the basis for its assault on industry leaders.

Solid Edge was yet another of UGS’s savvy acquisitions. Betting that mainstream solid modeling was going to catch on and become more than a tactical segment of the CAD market, UGS purchased Intergraph’s Solid Edge business in 1998 for a reported $105 million. Today, mainstream solids modeling is a growing and viciously fought over CAD market segment. In the past SolidEdge suffered from half-hearted marketing, sales and distribution, and somewhat lukewarm support from UGS’s marketing and sales management. With about 15% market share by revenue, and growth of 10% in 2004 to $55 million, Solid Edge is clearly one of the company’s least utilized strategic assets. UGS’s challenge in this segment, like that of its competitors, is to position Solid Edge against its high price-per-seat CAD products in such a way that it does not siphon away potential premium CAD sales, while at the same time promoting Solid Edge’s excellent features and value. Also a challenge will be growing and improving Solid Edge’s channel of independent resellers as the best of these are constantly courted by the company’s competitors.

Parasolids was another small, but prescient, UGS acquisition that turned out to be very fortuitous. A robust solids modeling kernel, Parasolids serves as the spark plug for UGS’s CAD offerings as well as being widely embedded in the CAD offerings of competitors, some of whom have been very successful with it.

Last year, UGS established a strong foothold in the CAE marketplace, the fastest growing segment of PLM, through its acquisition of a version of NASTRAN and related materials from MSC Software, the world’s leading CAE supplier. NASTRAN nicely augments UGS’s other CAE offerings, many acquired as a result of the SDRC deal. UGS is now right at the heart of the CAE market, and although results from NASTRAN thus far have been somewhat modest, UGS is well positioned to grow its presence in this vital market segment, which, in time, could eclipse CAD in strategic importance. The UGS marketing team has made CAE a priority, and we expect this part of UGS’s business to take off as the marketing and sales focus sharpens.

UGS is also very well positioned to integrate CAE workflows, models and results into its Teamcenter product stream and is likely to be the first of the major PLM suppliers to offer such close integration. For many years now, leading users from the automotive industry have been making presentations at Daratech’s CAE conference demanding such integration. It’s good to see that this now has the full attention of the leading PDM company.

Long an also-ran with great technology, Tecnomatix has produced impressive results for key automotive customers. Long on technology and short on marketing, sales and customer relations acumen, the company had been struggling in recent years because of softness in its electronics industry business, allowing UGS to acquire it for less than its true value. We expect Tecnomatix’s technology to have an ever-stronger presence in the marketplace that will help UGS build strength in important automotive, aerospace and electronics accounts.

But even with all of these successful acquisitions under its belt, it’s unlikely UGS will stop here. UGS remains a cash-rich company with powerful financial backers known to make heavy bets on potential to winners. It does not take a great deal of creativity to imagine the power and added breadth of integrated solutions UGS might bring to market with additional strategic acquisitions.

UGS has had success recently stressing the openness of its software compared to that of its rivals. UGS believes that the expertise it has gained managing complex Teamcenter installations in heterogeneous CAD environments gives it a distinct competitive advantage that has led the company to create and promote the JT Open standard. Daratech will be conducting a study later this year titled “Open Systems: Best Practices for Interoperability” that will examine the whole issue of openness, interoperability, and technology-based obstacles to collaboration.

Perhaps one of the best-kept secrets of UGS’s success is its software development prowess. Unlike some in the industry, UGS has not been embarrassed by late releases, bad releases, or very long product pre-announcements.

Indeed, UGS has a great R&D track record, with few in the PLM industry able to rival its on-time delivery of high quality software, or its ability to deploy this software at customer sites at light speeds. Truly a software development powerhouse, UGS is unlikely to cede new technical territory to any of its rivals.

At the start of 2005, UGS has 4 million users, revenue of about $1 billion per year, a three billion dollar revenue target, strong backing from its financial sponsors, and a strong vision for the future. The company is preparing for an IPO that will allow it to retire some of its debt, reward employees – and build its war chest for future acquisitions and attacks on competitors. UGS will be a formidable presence in the PLM market for years to come – but stay tuned for the details.