China's smartphone shipments to grow 6%

China's mobile phone shipments registered at 97 million units in Q1 2013, up 15% compared with the same period in 2012, while China's smartphone shipments totaled 78 million units in Q1 2013, with a growth of 117% compared with the same period in 2012.

International Data Corporation (IDC) believes such a high-speed growth of China's smartphone market would not be possible without China Mobile's efforts.

According to IDC's 2013 Q1 China Mobile Phone Quarterly Tracker, shipments of TDMC-based (Time Division Multiple Access) smartphones reached 28 million units in Q1 2013, with a year-on-year growth of 390%. This resulted in the share of smartphones in China's mobile phone market reaching a new high of 79%.

From the perspective of vendors, in terms of smartphone shipments, Samsung continues to rank as No 1 with a market share of 19% and a link relative ratio of 34%. Its shipments of products under $200 grew by 47%.

In Q1 2013, Apple ranked the fifth with a market share of 9% and a link relative ratio of 21%. The shipments of iPhone4 (8G), which is an excellent performer, grew by 211% over the previous quarter.

Except Huawei, despite the recent release of their operator-subsidized products, other large domestic mobile phone vendors have not experienced a prominent increase in their Q1 shipments.

Antonio Wang, associate director of Computing Systems Research Group of IDC China, says, "In China's smartphone market, Samsung has switched its marketing focus from competing with Apple for high-end market to maintaining its high-end market share, and is starting to strive for market for products under $200, which has so far been dominated by domestic brands. However, Apple leverages the incentive policies for channels to inspire the shipments of iPhone4, further expanding its user base."

IDC predicts that, thanks to operator subsidies and robust consumer demands for new phones, China's smartphone shipments will increase sharply in 2013; in 2017, smartphone shipments will exceed 460 million units to reach a market size of RMB 740.5 billion ($117.8 billion).

IDC research indicates that the development of smartphones will inevitably drive the innovation of the entire industry chain, further promoting the perfection of mobile communications and mobile internet ecosystem.

James Yan, senior analyst of IDC China, who is responsible for mobile phone market research, predicts that the development trends of China's mobile phone industry chain will manifest in the following aspects in the next five years:

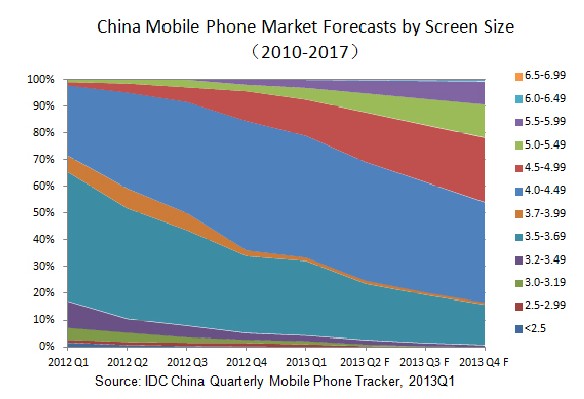

By the end of 2013, the market share of smartphones with screens 5-inch and above will exceed 20%. Influenced by the operators' demands for customized product specifications (large screen over 5 inches, dual-core/quad-core) and the positive effect of Samsung's GALAXY S and Note series on the growth of large-screen mobile phone market, large-screen mobile phones are gradually becoming acceptable to consumers. As a result, mobile phone vendors quickly responded with the release of a large amount of smartphones with 5-inch above screens. IDC data indicates that, as of Q1 2013, the market share of 5-inch above smartphones reached 7.5%, up 74% over the previous quarter. IDC forecasts that this figure will exceed 20% by the end of 2013.

Large domestic vendors will acquire upstream and downstream businesses to close gaps in supply chain. Domestic brands, which have encountered many bottlenecks in developing high-end products, such as product patent subjected to limits and core components controlled by large foreign vendors, need to urgently integrate the upstream and downstream of the industry chain or consider merger and acquisition (M&A) strategies. IDC expects that many M&As in relation to the industry chain will emerge in the next two years.

Vendors will prepare themselves for mobile internet and communications to enhance stickiness or vie for mobile Internet entrance. It is difficult for mobile phone vendors to differentiate by simply upgrading hardware for higher premium. Getting ready for mobile internet services, such as app store, voice input, mobile browser, mobile desktop and cloud service, has become an inevitable competition strategy for vendors to enhance stickiness and vie for mobile internet entrance in the future.

Efforts will be made to develop wearable terminals and mobile services such as somatosensory live action. Along with the development of flexible materials and sensing devices, mobile phone peripherals and wearable terminals will enter the development stage; meanwhile, industrial applications (including health care and education) and consumer services (such as life tools, gaming and shopping) will attract more attention.

According to IDC's 2013 Q1 China Mobile Phone Quarterly Tracker, shipments of TDMC-based (Time Division Multiple Access) smartphones reached 28 million units in Q1 2013, with a year-on-year growth of 390%. This resulted in the share of smartphones in China's mobile phone market reaching a new high of 79%.

From the perspective of vendors, in terms of smartphone shipments, Samsung continues to rank as No 1 with a market share of 19% and a link relative ratio of 34%. Its shipments of products under $200 grew by 47%.

In Q1 2013, Apple ranked the fifth with a market share of 9% and a link relative ratio of 21%. The shipments of iPhone4 (8G), which is an excellent performer, grew by 211% over the previous quarter.

Except Huawei, despite the recent release of their operator-subsidized products, other large domestic mobile phone vendors have not experienced a prominent increase in their Q1 shipments.

Antonio Wang, associate director of Computing Systems Research Group of IDC China, says, "In China's smartphone market, Samsung has switched its marketing focus from competing with Apple for high-end market to maintaining its high-end market share, and is starting to strive for market for products under $200, which has so far been dominated by domestic brands. However, Apple leverages the incentive policies for channels to inspire the shipments of iPhone4, further expanding its user base."

IDC predicts that, thanks to operator subsidies and robust consumer demands for new phones, China's smartphone shipments will increase sharply in 2013; in 2017, smartphone shipments will exceed 460 million units to reach a market size of RMB 740.5 billion ($117.8 billion).

IDC research indicates that the development of smartphones will inevitably drive the innovation of the entire industry chain, further promoting the perfection of mobile communications and mobile internet ecosystem.

James Yan, senior analyst of IDC China, who is responsible for mobile phone market research, predicts that the development trends of China's mobile phone industry chain will manifest in the following aspects in the next five years:

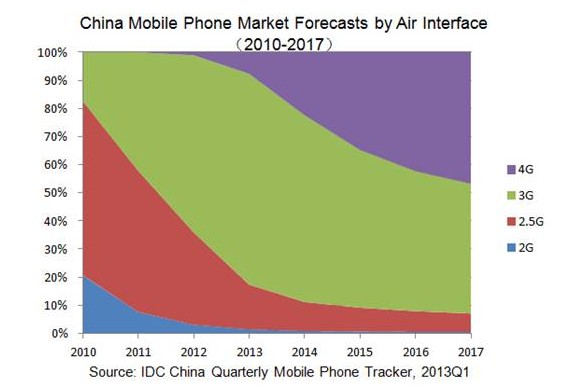

4G smartphone will make up 40% market share in 2017.[Graph/IDC]

By 2017, 4G mobile phone shipments will outnumber 3G mobile phone shipments. IDC predicts that, with an increasing share of upstream 4G chip vendors engaging in mass production, the push by China's three major operators, and the support from terminal vendors, the shipments of 4G mobile phones will outnumber those of 3G mobile phones in 2017. That will further promote the development of the entire mobile communications and mobile internet industry.By the end of 2013, the market share of smartphones with screens 5-inch and above will exceed 20%. Influenced by the operators' demands for customized product specifications (large screen over 5 inches, dual-core/quad-core) and the positive effect of Samsung's GALAXY S and Note series on the growth of large-screen mobile phone market, large-screen mobile phones are gradually becoming acceptable to consumers. As a result, mobile phone vendors quickly responded with the release of a large amount of smartphones with 5-inch above screens. IDC data indicates that, as of Q1 2013, the market share of 5-inch above smartphones reached 7.5%, up 74% over the previous quarter. IDC forecasts that this figure will exceed 20% by the end of 2013.

The market share of smartphones with screens 5-inch and above will exceed 20%.[Graph/IDC]

Large domestic vendors will acquire upstream and downstream businesses to close gaps in supply chain. Domestic brands, which have encountered many bottlenecks in developing high-end products, such as product patent subjected to limits and core components controlled by large foreign vendors, need to urgently integrate the upstream and downstream of the industry chain or consider merger and acquisition (M&A) strategies. IDC expects that many M&As in relation to the industry chain will emerge in the next two years.

Vendors will prepare themselves for mobile internet and communications to enhance stickiness or vie for mobile Internet entrance. It is difficult for mobile phone vendors to differentiate by simply upgrading hardware for higher premium. Getting ready for mobile internet services, such as app store, voice input, mobile browser, mobile desktop and cloud service, has become an inevitable competition strategy for vendors to enhance stickiness and vie for mobile internet entrance in the future.

Efforts will be made to develop wearable terminals and mobile services such as somatosensory live action. Along with the development of flexible materials and sensing devices, mobile phone peripherals and wearable terminals will enter the development stage; meanwhile, industrial applications (including health care and education) and consumer services (such as life tools, gaming and shopping) will attract more attention.