Intel, Samsung saw 2006 chip revenue slowdowns in Greater China

These robust double-digit increases demonstrate China's capability to compensate for moderate semiconductor market growth globally.

Although on the whole semiconductor shipments in Greater China saw healthy growth in 2006, analysts report that the struggles experienced there by major companies like Intel Corp. and Samsung Electronics Co. Ltd. do not bode well for the industry as a whole.

According to market research firm iSuppli Corp., total semiconductor shipments in Greater China -- consisting of Mainland China, Hong Kong and Taiwan -- totaled $66.3 billion in 2006, up 11.8 percent from $59.3 billion in 2005.

The firm said that semiconductors shipped to China and Hong Kong increased to about $44.8 billion in 2006, up 15.8 percent from $38.6 billion in 2005. Meanwhile, semiconductor sales in Taiwan reached $21.5 billion, representing just 4.2 percent growth compared to 2005.

"These robust double-digit increases demonstrate China's capability to compensate for moderate semiconductor market growth globally," Byron Wu, director of China research for iSuppli, said in a statement issued today. "However, because Taiwanese original design manufacturers (ODM) continue to transfer production to Mainland China, semiconductor shipments to Taiwan have experienced flat growth in recent years."

iSuppli said the fact some leading suppliers in its top-10 ranked manufacturers of 2006 saw negative or slow growth "is not a good trend for the industry as a whole." The firm has predicted that the industry worldwide will see just 6 percent growth in 2007, down from the 9.6 percent growth seen in 2006 worldwide.

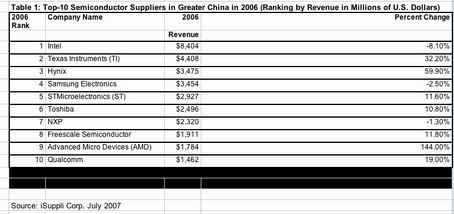

The firm said that Intel in 2006 was the leading semiconductor supplier in the Greater China market with shipment revenue of $8.4 billion; its 2006 performance was nonetheless some 8 percent lower than it was in 2005. Texas Instruments Inc. (TI) ranked second in revenue last year, with sales about half those of Intel. However, TI recorded 32.2 percent growth in 2006, iSuppli said, as some of its largest handset customers expanded production in the region.

Memory player Hynix Semiconductor Inc. became the third leading semiconductor supplier in the region in 2006, while Samsung took fourth place with a 2.5 percent drop in Greater China shipments during 2006. Fifth-ranked STMicroelectronics saw about 10 percent growth in the Greater China market. (See chart below for more of iSuppli's ranking.)

Seeing the most growth of all at a staggering 144 percent was ninth-ranked Advanced Micro Devices Inc., which iSuppli chalked up to its acquisition of ATI Technologies Inc. in October 2006.? Earlier this month, however, ATI's former president and CEO Dave Orton announced plans to leave his executive VP post at AMD at the end of July, expressing "mixed feelings" about his departure.

?