Planting the seeds for future growth

As timber demand increases in the country, China will need to boost domestic stocks and have a greater say in market prices.

His firm has one of the largest factories in Dalingshan, a major furniture exporting center in Dongguan, South China's Guangdong province.

Specializing in furniture, Jinmaoda employs 1,500 workers. But times are tough as prices for hardwood, such as Brazilian rosewood and Australian blackwood, spiral.

"Many Chinese furniture makers bought large amounts of hardwood for veneer, flooring and decorative products when lumber prices were much lower," Yin said. "This resulted in an oversupply of furniture products, which has since triggered a price war.

"But now that lumber costs are much higher, even after we sell our existing inventories we will still face increased prices when we stock up in new timber imports," he added. "This limited the nation's bargaining power in the global market."

China will need to play a bigger role in influencing the price of timber to prevent costs soaring on the international stage by increasing domestic stockpiles.

A widening supply gap has forced the world's largest wood importer to purchase more timber from Russia, the United States, Canada and New Zealand to meet surging demand.

Imports from countries in Southeast Asia and Africa have also climbed despite tougher regulations to combat smuggled shipments.

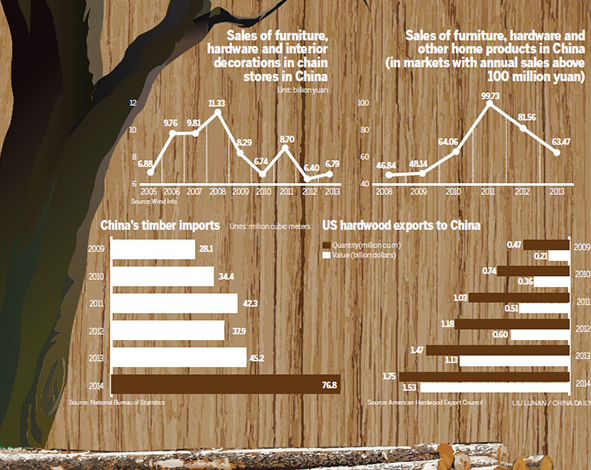

Last year, China's demand for foreign timber hit 76.8 million cubic meters, a 40 percent increase compared to 2013, according to the General Administration of Customs.

Zhang Jianlong, deputy director of the State Forestry Administration, put this down to China's booming construction sector, which is relying on more "green" building materials, and an increase in furniture manufacturing.

By 2020, demand for timber is expected to jump to 800 million cu m.

Naturally, the government is eager to prevent the cost of wood spiraling by cutting imports by 10 percentage points from the current 60 percent level during the next five years.

Forest programs and research and development into new building materials, will help close the gap. "Because of legal and environment reasons, dwindling timber shipments from Brazil, Myanmar, Ghana and Gabon have become an increasingly pressing issue," Zhang said.

"It is therefore important to put together a reliable supply chain."

Helping the furniture industry cope with this changing landscape will be vital. In Dalingshan, 400,000 workers are employed in the sector, but last year exports from the town fell 11 percent to $437 million compared to 2013, the Dongguan Furniture Industrial Association reported.

Apart from increased prices and oversupply, tough new European Union standards have also hit Chinese exports to EU countries.

"These new ecological requirements, such as adhesives and varnish coatings in furniture products, have increased costs," Yin, of Jinmaoda, said.

Shunde Empire Group, a major furniture retail chain based in Guangdong province, is now operating in a more difficult economic environment.

Cen Zhijiang, a company director, stressed that a number of furniture manufacturers are facing increased costs as wood prices rise and overseas orders shrink.

Typically, the price of timber from India, Nigeria and Brazil jumped between 11 percent and 13 percent in the first quarter compared to the same period in 2014. "Several of our suppliers have shifted their production from wood to bamboo furniture as well as related products such as green building materials," Cen said.

"But the market hasn't responded enthusiastically because many customers question the durability of bamboo furniture. It also doesn't look very expensive."

Increasing domestic timber supplies is the next logical step. In 1998, the government moved to save the country's forests after facing timber shortages of about 60 million cu m per year by launching a protection program.

Now there are 198 million hectares of natural forests, with 127 million hectares protected by the Natural Forest Program.

During the past five years, annual timber consumption has reached nearly 500 million cu m.

To help feed demand, 14 million hectares of new forests have sprung up in Northeast China since 2010 as part of a government-backed program. In the next five to eight years, these forests could supply up to 95 million cu m.

But that will only solve part of the problem. Another reason for fluctuating timber prices is that China lacks international influence in the global market.

Deng Huafeng, a professor at the Beijing Forestry University, pointed to the lack of a prestigious commodity exchange such as the Chicago Board of Trade.

The world's biggest futures and options exchange in the US sets the global benchmark price for timber.

"Reports by the Shanghai Timber Trading Center and Chengdu-based China International Timber and Wood Product Exchange lack authority on the global market," Deng said.

"That has resulted in China lowering its voice when negotiating timber prices with international sellers."

The country will need to find a stronger voice in the future as demand for timber accelerates.

Under the government's plan, at least 30 percent of new buildings will have to be environmentally friendly by 2020.

By the end of this year, 20 percent of new urban construction will have to be eco-friendly.

"Even though future demand in China's furniture market continues to depend on the domestic housing sector, the country has entered the second phase of urbanization," Deng said.

"That will lead to another wave in demand for timber."