Time to play now!

China lifting the ban on the production and sales of gaming consoles gives game console makers a golden opportunity.

The floodgates for both domestic and overseas gaming console providers have finally fully opened.

The State Council, or the cabinet, announced on Jan 29 that the reform experiences of the China (Shanghai) Pilot Free Trade Zone will be promoted nationwide, which means that the ban on gaming consoles, which was lifted in the Shanghai FTZ in September 2013, will be rolled out nationwide. As a result, joint ventures in the FTZ and Chinese companies will be able to produce and sell gaming consoles in the country.

In 2000, the central government banned the production and sales of gaming consoles, amid concerns that they had a harmful effect on young people and could disturb social order.

But new hope was offered to the nation's struggling gaming industry with the framework policy of Shanghai FTZ, which was officially launched in September 2013. Approval for the production of sales of gaming consoles has been one of the highest-profile developments in the FTZ. The two industry giants, Sony Corp and Microsoft Corp, announced the release of their most celebrated devices later last year.

To ensure their success in the Chinese market, the two industry leaders both sought cooperation with a Chinese domestic company. Sony set up two joint ventures with A-share listed Oriental Pearl Group, while Microsoft worked with Shanghai-based BesTV New Media Co Ltd.

However, the sales figures were not that cheerful. Even though a total of 100,000 Xbox One devices were sold on the day the console was officially released in China, the annual sales target for the Chinese market in 2015 was only 1 million sets. But in the United States, 900,000 Xbox One sets were sold in the first month after the product was released.

Sony has experienced more turbulence. It had to postpone the planned Jan 11 introduction of its PlayStation 4 console in China to March 20 after Beijing asked for adjustments. Kaede Bun, a spokesman for Sony Computer Entertainment Inc, said that the company's game unit needs time to make the changes, without elaborating on what was actually required.

But the companies seem to have foreseen the difficulties and still have enough faith in the market.

"With much faith and ambition, we have entered a brand new market, which might be filled with hardship and challenges. The Chinese gaming console industry is in its renaissance, and we are making efforts every day to lay the groundwork for the entire industry," said Xie Enwei, general manager of Microsoft China region.

Meanwhile, market watchers also have expressed great confidence in the outlook for this embryonic industry. Lewis Ward, research director of gaming at IDC, said his firm found that China's current console penetration rate is in the "single digits". But given China's huge population, that low rate already translates into millions of potential customers.

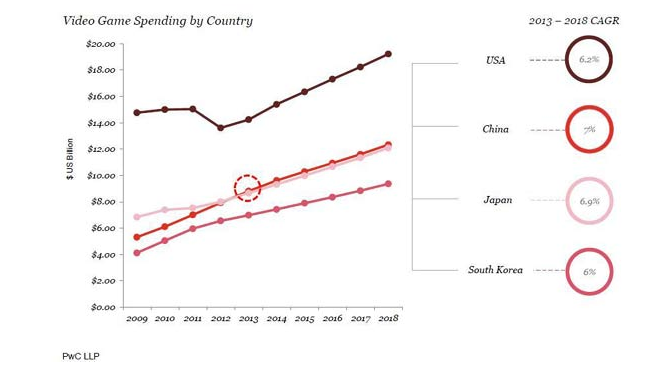

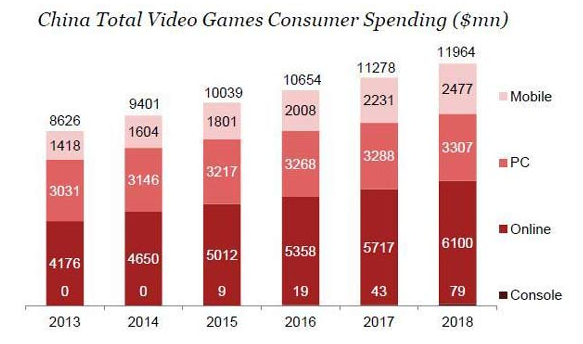

In terms of total video game revenue, China has already overtaken Japan to move into second place globally in 2013. The Chinese video games industry will expand at a compound annual growth rate of 6.8 percent between 2013 and 2018. Console games will see their market volume reach $79 million by 2018, according to PricewaterhouseCoopers.

"The game playing Chinese consumer is demonstrating an increasing appetite to engage in gaming on their mobile device. This social phenomenon is creating opportunities not only for specialist game developers, but also for content companies of all types to look at gamification as a means of increasing their reach and engagement," said William Lam, PwC China Entertainment and Media Partner.

The market volume of the game industry is even much larger than the Chinese movie industry, which was estimated to have sales revenue of 28 billion yuan last year. However, Qilu Securities estimates that China's video games market volume will be around 40 billion yuan ($6.3 billion), half of which will be taken up by the joint venture between Sony and Oriental Pearl. By the end of 2019, core users in China are very likely to buy 50 million to 100 million game consoles.

"Two of the world's leading game manufacturers have entered China. Each of them will be able to seek a sales revenue of 10 billion yuan in the long run as market demand thrives and distribution channels are completed," said Chen Yunhong, an analyst with Qilu Securities.

Fitch Ratings has also produced an upward revision of Sony's earnings forecast for the year ending March 2015 based on improved prospects for the device segment, including its market-leading image sensor business, game revenues and steady progress with its restructuring.

As Sealand Securities has estimated, the potential market growth rate of the Chinese video game industry will remain at 20 percent annually in the next few years. According to the 2014 China Gaming Industry Report complied by the Game Publishing Committee of the Chinese Audio-Visual and Digital Publishing Association, as video games become more popular among Chinese families, family entertainment will exert a long-term impact on the Chinese gaming industry.

Liao Shuhan, a senior market analyst with the client system research department of IDC China, said that video games will become the new focus of the smart TV industry in 2015.

"The green light given to game consoles is good news for video games. With the rapid expansion of the video games market, leading Internet companies, games companies and venture capitalists have all eyed the video game industry. As a result, the video games industry will enter a new era of fast development in 2015 with the preliminary industry structure formed," he said.

The State Council, or the cabinet, announced on Jan 29 that the reform experiences of the China (Shanghai) Pilot Free Trade Zone will be promoted nationwide, which means that the ban on gaming consoles, which was lifted in the Shanghai FTZ in September 2013, will be rolled out nationwide. As a result, joint ventures in the FTZ and Chinese companies will be able to produce and sell gaming consoles in the country.

In 2000, the central government banned the production and sales of gaming consoles, amid concerns that they had a harmful effect on young people and could disturb social order.

But new hope was offered to the nation's struggling gaming industry with the framework policy of Shanghai FTZ, which was officially launched in September 2013. Approval for the production of sales of gaming consoles has been one of the highest-profile developments in the FTZ. The two industry giants, Sony Corp and Microsoft Corp, announced the release of their most celebrated devices later last year.

To ensure their success in the Chinese market, the two industry leaders both sought cooperation with a Chinese domestic company. Sony set up two joint ventures with A-share listed Oriental Pearl Group, while Microsoft worked with Shanghai-based BesTV New Media Co Ltd.

However, the sales figures were not that cheerful. Even though a total of 100,000 Xbox One devices were sold on the day the console was officially released in China, the annual sales target for the Chinese market in 2015 was only 1 million sets. But in the United States, 900,000 Xbox One sets were sold in the first month after the product was released.

Sony has experienced more turbulence. It had to postpone the planned Jan 11 introduction of its PlayStation 4 console in China to March 20 after Beijing asked for adjustments. Kaede Bun, a spokesman for Sony Computer Entertainment Inc, said that the company's game unit needs time to make the changes, without elaborating on what was actually required.

But the companies seem to have foreseen the difficulties and still have enough faith in the market.

"With much faith and ambition, we have entered a brand new market, which might be filled with hardship and challenges. The Chinese gaming console industry is in its renaissance, and we are making efforts every day to lay the groundwork for the entire industry," said Xie Enwei, general manager of Microsoft China region.

Meanwhile, market watchers also have expressed great confidence in the outlook for this embryonic industry. Lewis Ward, research director of gaming at IDC, said his firm found that China's current console penetration rate is in the "single digits". But given China's huge population, that low rate already translates into millions of potential customers.

In terms of total video game revenue, China has already overtaken Japan to move into second place globally in 2013. The Chinese video games industry will expand at a compound annual growth rate of 6.8 percent between 2013 and 2018. Console games will see their market volume reach $79 million by 2018, according to PricewaterhouseCoopers.

"The game playing Chinese consumer is demonstrating an increasing appetite to engage in gaming on their mobile device. This social phenomenon is creating opportunities not only for specialist game developers, but also for content companies of all types to look at gamification as a means of increasing their reach and engagement," said William Lam, PwC China Entertainment and Media Partner.

The market volume of the game industry is even much larger than the Chinese movie industry, which was estimated to have sales revenue of 28 billion yuan last year. However, Qilu Securities estimates that China's video games market volume will be around 40 billion yuan ($6.3 billion), half of which will be taken up by the joint venture between Sony and Oriental Pearl. By the end of 2019, core users in China are very likely to buy 50 million to 100 million game consoles.

"Two of the world's leading game manufacturers have entered China. Each of them will be able to seek a sales revenue of 10 billion yuan in the long run as market demand thrives and distribution channels are completed," said Chen Yunhong, an analyst with Qilu Securities.

Fitch Ratings has also produced an upward revision of Sony's earnings forecast for the year ending March 2015 based on improved prospects for the device segment, including its market-leading image sensor business, game revenues and steady progress with its restructuring.

As Sealand Securities has estimated, the potential market growth rate of the Chinese video game industry will remain at 20 percent annually in the next few years. According to the 2014 China Gaming Industry Report complied by the Game Publishing Committee of the Chinese Audio-Visual and Digital Publishing Association, as video games become more popular among Chinese families, family entertainment will exert a long-term impact on the Chinese gaming industry.

Liao Shuhan, a senior market analyst with the client system research department of IDC China, said that video games will become the new focus of the smart TV industry in 2015.

"The green light given to game consoles is good news for video games. With the rapid expansion of the video games market, leading Internet companies, games companies and venture capitalists have all eyed the video game industry. As a result, the video games industry will enter a new era of fast development in 2015 with the preliminary industry structure formed," he said.